The cryptocurrency market operates 24/7, offering unique opportunities to analyze trading behaviors across different times of the week. This article examines the distinct patterns in trading trends occurring during the weekend in comparison with the rest of the week.

Evolution of Bitcoin weekend trading volume

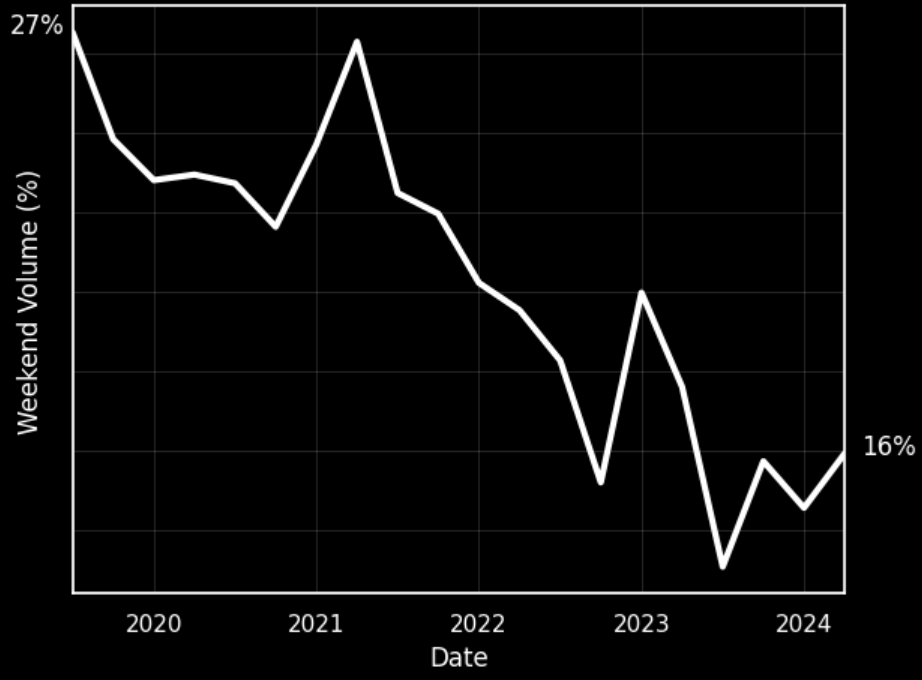

Let's first examine BTC/USDT perpetual futures on Binance, the most liquid market for BTC. Currently, we can see that 16% of the weekly trading volume occurs during the weekend on average. There has been a significant decrease in the share of weekend trading volume: trading volume used to be more evenly distributed though the entire week as the weekend trading volume share was about 27%, suggesting that it was nearly as high as the weekdays volume in proportion (weekends represent 28.5% of the total week duration).

Share of Weekend Trade Volume for BTC/USDT

Source: BTC/USDT perpetual futures on Binance

This trend is not unique to Binance. A similar pattern is observed across all major exchanges. For example, Bybit and OKX show the same decline in the share of weekend trading volumes.

Share of Weekend Trade Volume for BTC/USDT

Source: BTC/USDT perpetual futures on Binance, OKX, Bybit

Comparison with other assets and products

Let's examine other assets on Binance futures during Q2 2024:

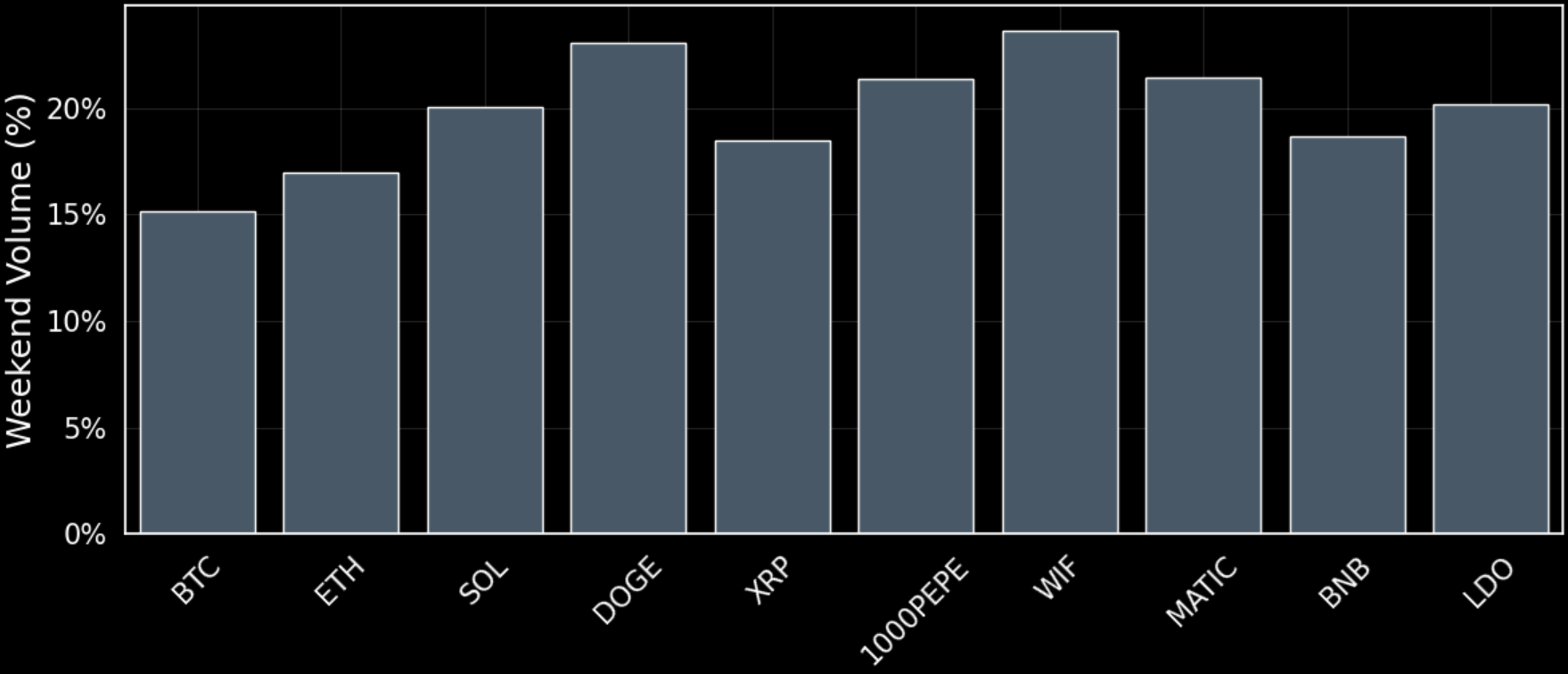

Share of Weekend Trade Volume

Source: USDT-margined perpetual futures on Binance, 01/04/2024-30/06/2024

There are significant differences in the share of weekend trading volume between various assets. It is clear that meme coins such as DOGE, WIF, and 1000PEPE experience higher activity during the weekends compared to other assets. This trend might be attributed to the increased participation of retail traders, who might be more active during weekends.

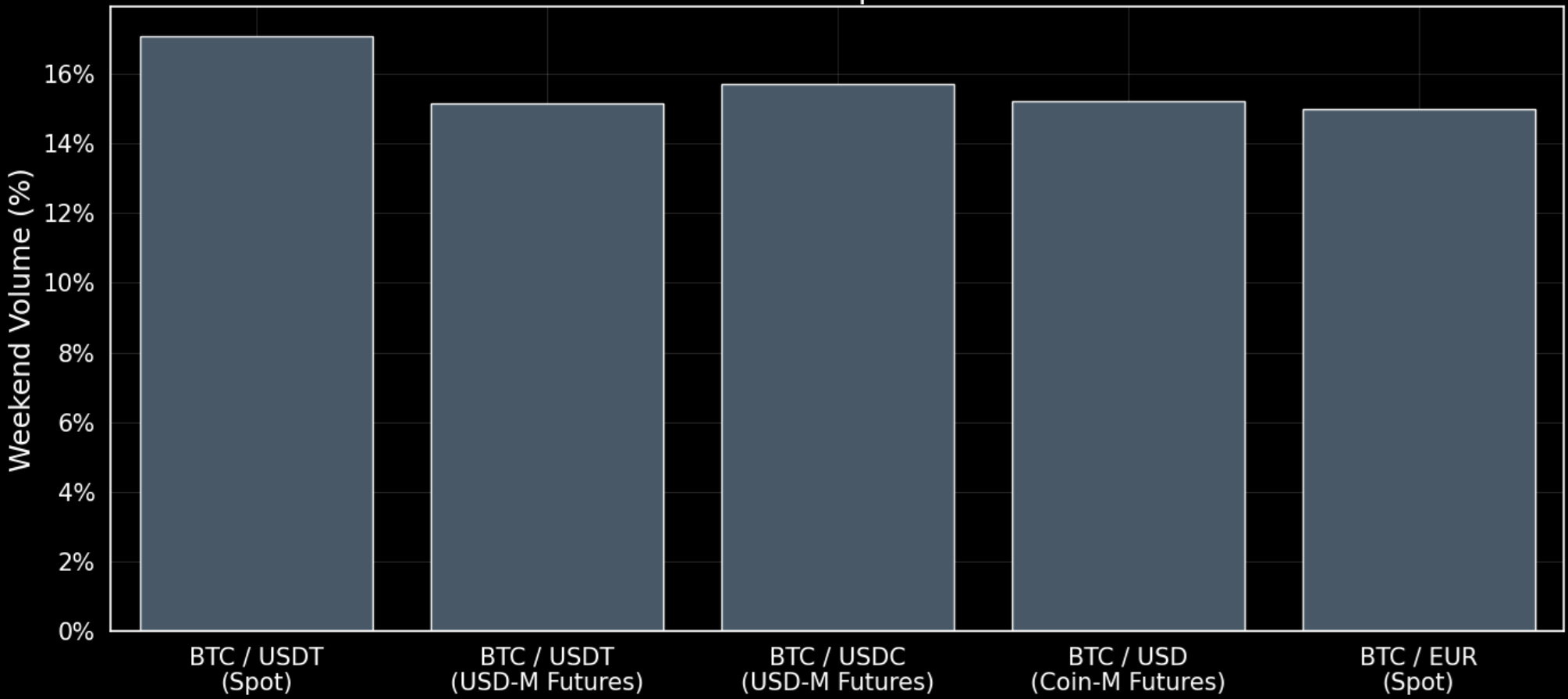

If we step back to bitcoin and take a look at different Bitcoin products we can notice that there is no significant differences:

Share of Weekend Trade Volume

Source: Binance, 01/01/2024 - 30/06/2024

Liquidity and Volatility

An important question one might ask is the liquidity during weekends. Trading volume being much lower, it could be more difficult to execute a trade with minimal slippage compared to other days of the week.

It might be surprising, but orderbooks are actually just as deep during the weekend:

50bps Orderbook Depth for BTC/USDT

Source: 50bps depth, BTC/USDT Binance perpetual futures.

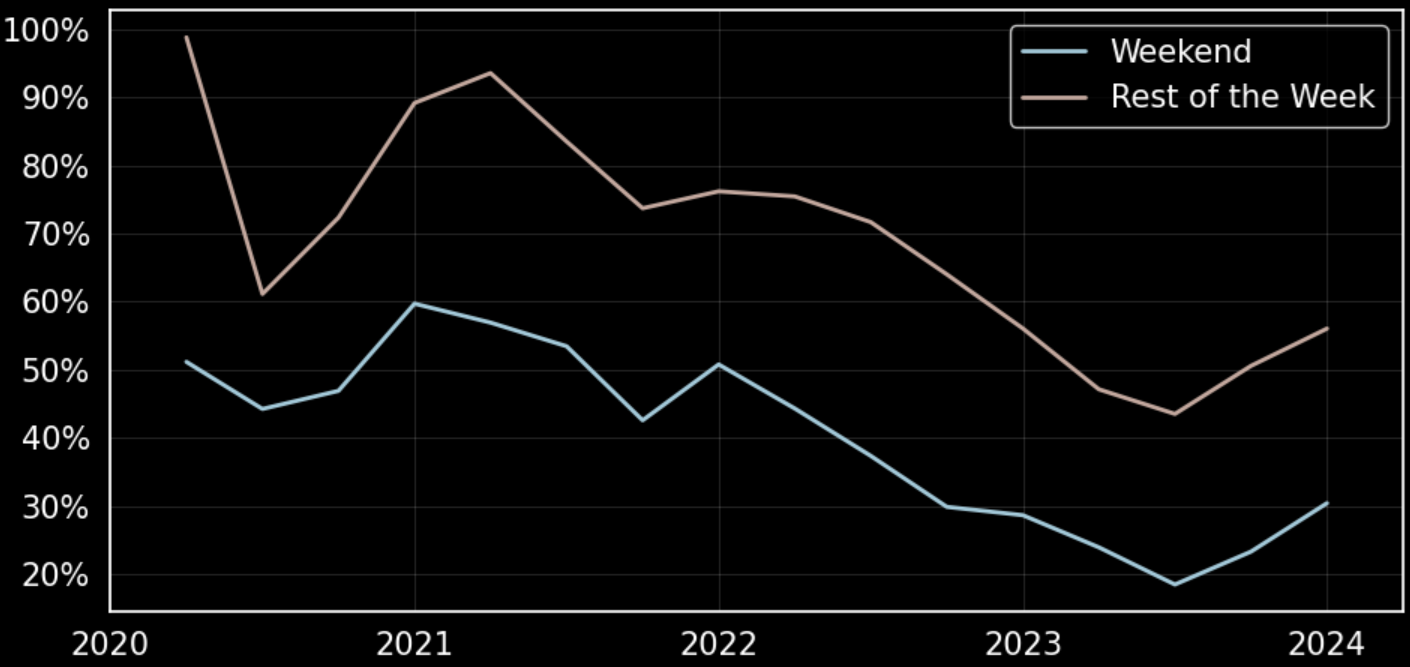

Average volatility is significantly lower during weekends compared to weekdays. Recently, average weekend volatility was half of the average weekday volatility.

Annualized Volatility for BTC/USDT

Source: BTC/USDT perpetual futures on Binance

The reduced volatility might explain why order books remain so deep during weekends: low volatility could allow market makers to offer tight spreads and maintain large limit orders despite the lower trading volumes.